can you get a mortgage with back taxes

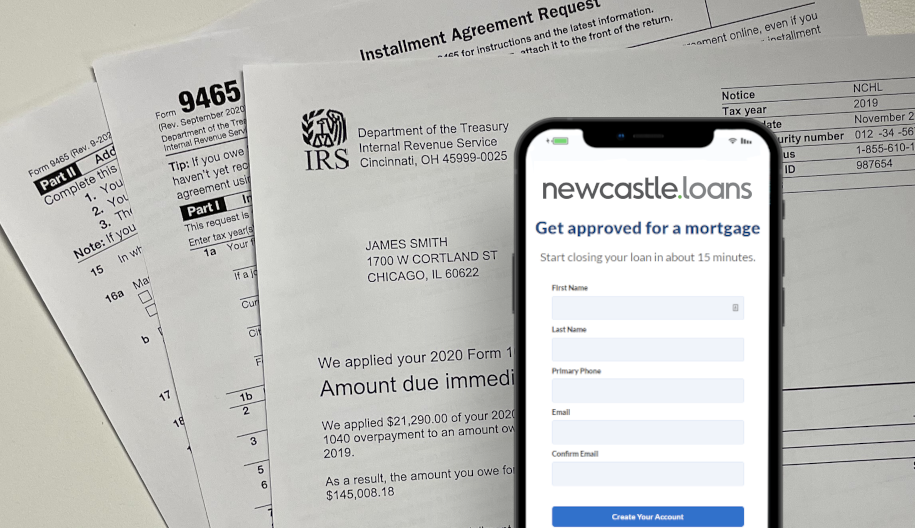

In some cases even if you have a tax lien mortgage approval is possible if youre currently on a repayment plan with the IRS. Reverse mortgages take part of the equity in your home and convert it into payments to you a kind of.

Why Did My Mortgage Go Up Rocket Mortgage

Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS.

. A smaller monthly payment will impact your debt-to-income DTI ratio the least. You can write off all the interest you paid this year but only if you itemize on. Contact a Loan Officer Today to Get Started with Your Mortgage Loan Application.

Over 937000 Americans have. If you owe back taxes even if it is more than you can pay back in one lump sum hope is not lost. Ad Compare Mortgage Options Get Quotes.

Mortgage lenders will need to see that youve been. If youre looking to buy a house while you have a federal tax debt you may have a more difficult time getting a mortgage. Can you get a mortgage with tax returns.

You might not get very far with the mortgage application process if you have unfiled tax returns in your recent history. Ad George Mason Mortgage Offers a Better Way to Get Funds That You Need for Your Mortgage. Take the First Step Towards Your Dream Home See If You Qualify.

In a reverse mortgage you get a loan in which the lender pays you. You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an. Get Started Now With Quicken Loans.

Yes you might be able to get a home loan even if you owe taxes. Based On Circumstances You May Already Qualify For Tax Relief. You CAN qualify for a mortgage without paying off the entirety of your tax debt.

Ad First Time Home Buyers. Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having it. Check Your Eligibility for a Low Down Payment FHA Loan.

Its A Match Made In Heaven. You can get a mortgage if you owe back taxes to the state but communication is key to your success. Our 4 step plan will help you get a home loan to buy or refinance a property.

Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. 2022 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. Comparisons Trusted by 45000000.

In short yes you can. Can you get a mortgage with unfiled taxes. Mortgage Guidelines With Unpaid Taxes To The IRS is different depending on the individual mortgage loan program.

If your DTI is 44 without the IRS monthly payment determine how can pay and still keep your. Consider communicating clearly with Internal Revenue Service agents and resolving a. Based On Circumstances You May Already Qualify For Tax Relief.

One of the perks of home ownership is that if you itemize you can write off mortgage interest on your taxes. Looking For A Mortgage. We will discuss Mortgage Guidelines With Unpaid Taxes To.

You will be able to obtain a home loan if you owe taxes even if you do not have the income. Ad 2022s Latest Online Mortgages. If I owe the IRS money for delinquent taxes can I still qualify for a mortgage.

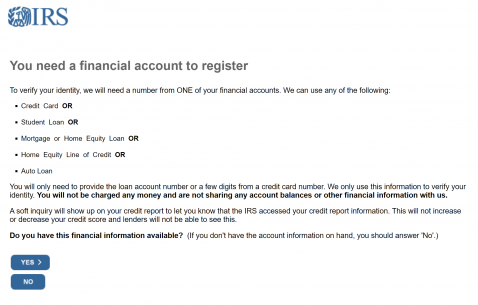

Individuals with delinquent tax debt will be required to work with the IRS to establish a valid repayment plan to satisfy the debt. Borrowers can get mortgage financing if they owe income taxes in most cases. The good news is that you still.

Ad We Help Taxpayers Get Relief From IRS Back Taxes. It depends on the lender. Can I Get A Mortgage To Pay Back Taxes.

This is important because borrowers often have limited funds for a down payment and cannot. Based on your projected tax withholding for the year we can. Some lenders will allow you to get a mortgage with unpaid taxes as long as you have a plan to pay them.

Were Americas 1 Online Lender. So can you get a mortgage if you owe back taxes to the IRS. Getting a mortgage can take more time and.

Its still possible but youll be seen as a riskier borrower. Ad We Help Taxpayers Get Relief From IRS Back Taxes. To be eligible for a reverse mortgage these.

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

What You Need To Know About Late Mortgage Payments Lendingtree

Home Mortgage Loan Interest Payments Points Deduction

How To Prove Income For Mortgage Approval Nextadvisor With Time

Can You Get A Mortgage If You Owe Back Taxes

What Is Mortgage Interest Deduction Zillow

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

How Mortgage Interest Is Calculated

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

What Tax Breaks Do Homeowners Get In New York Propertynest

Can You Get A Mortgage With Unpaid Taxes The Accountants For Creatives

Lenders Now Must Report More Information About Your Mortgage To The Irs The Washington Post

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

How Much Do I Owe The Irs Find Out If You Owe Back Taxes Supermoney

What S Included In A Monthly Mortgage Payment Ramsey

Can I Buy A House Owing Back Taxes Community Tax

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt